In the dynamic landscape of financial markets, investment firms play a crucial role in guiding investors with their insights and recommendations. One such firm, Morgan Stanley, has recently provided an optimistic outlook on a particular company’s stock. The firm has assigned an ‘Overweight’ rating to the stock with a target price of ₹45,400 for the next 12 months. This article delves into the details surrounding this rating, the company’s historical performance, and the potential factors influencing its future trajectory.

Overview of the Company

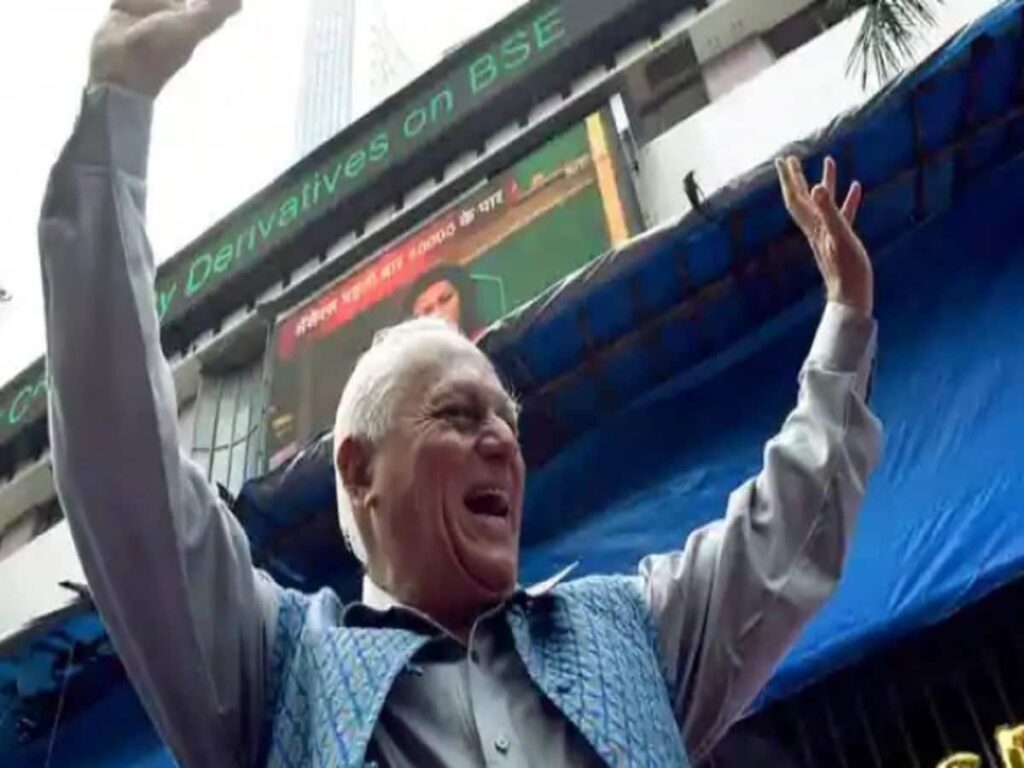

The company in focus, which went public in 2007, made its debut with an Initial Public Offering (IPO) price of ₹395. Since its inception, the company has navigated various market cycles and has positioned itself as a significant player in its industry. Understanding the historical performance and strategic initiatives of the company is essential for grasping the context of Morgan Stanley’s evaluation.

Historical Performance

| Year | IPO Price (₹) | Current Share Price (₹) | Market Capitalization (in billion ₹) |

|---|---|---|---|

| 2007 | 395 | Data pending | Data pending |

Analysis of Morgan Stanley’s Rating

Morgan Stanley’s ‘Overweight’ rating suggests that they believe the stock will outperform its peers over the next year. Analysts typically assign such ratings based on several factors, including company fundamentals, market conditions, and broader economic indicators.

Key Factors Influencing the Rating

- Financial Performance: Recent earnings reports and revenue growth may indicate a positive outlook.

- Market Trends: The company’s strategic positioning and response to market trends could enhance its growth prospects.

- Economic Indicators: Broader economic factors such as GDP growth, interest rates, and consumer spending play a vital role in shaping investor sentiment.

Implications for Investors

Investors considering the stock should weigh Morgan Stanley’s rating alongside their personal financial goals and risk tolerance. The target price of ₹45,400 represents potential upside for current shareholders, but it is essential to remain mindful of market volatility and economic uncertainties.

Conclusion

The ‘Overweight’ rating from Morgan Stanley, coupled with a target price of ₹45,400 for the next 12 months, reflects a positive outlook for the company’s stock. As it continues to build on its past performance since its IPO in 2007, investors are encouraged to conduct thorough research and consider both the company’s fundamentals and external economic factors that may influence its stock performance in the future.