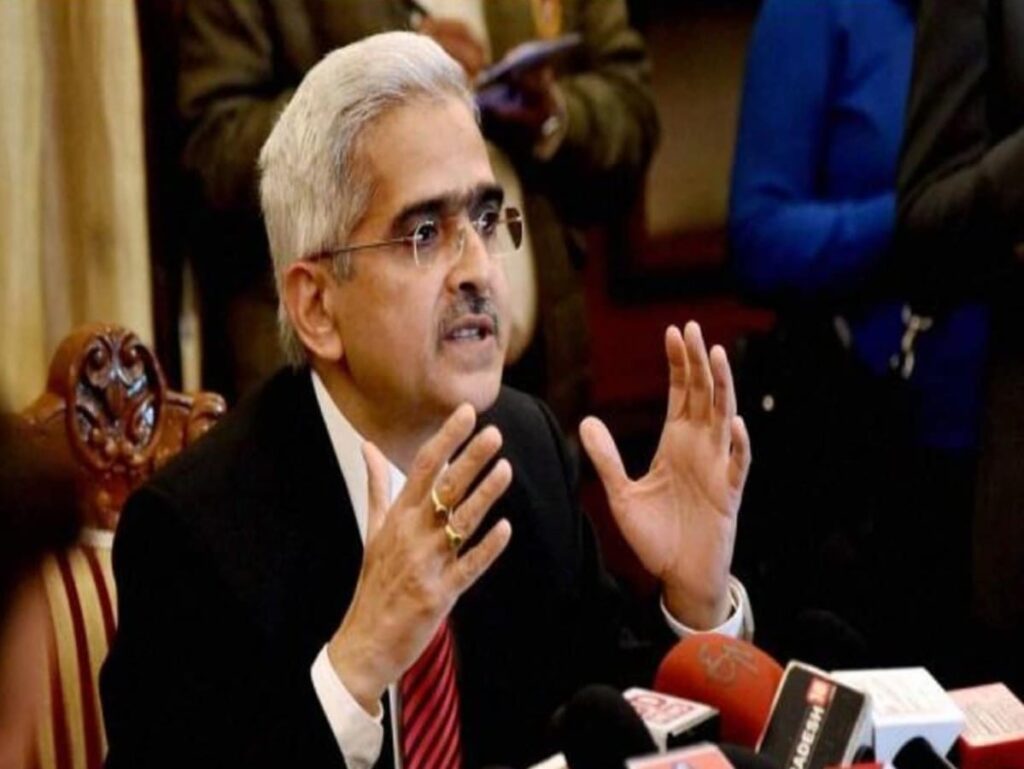

The recent statement from RBI Governor Shaktikanta Das has sparked discussions among economists and market analysts regarding the implications of the current repo rate and its potential impact on the economy. With the backdrop of persistent retail inflation, the dynamics of monetary policy in India are becoming increasingly complex. This article delves into the reasons behind the governor’s stance on repo rate cuts and the broader economic implications.

Understanding Repo Rate

Repo rate, or repurchase rate, is the rate at which the central bank of a country lends money to commercial banks, typically against government securities. It is a crucial tool for controlling inflation and regulating the economy’s money supply. A cut in repo rate could lead to lower interest rates on loans for consumers and businesses, potentially stimulating growth. However, timing is vital, especially in an inflationary environment.

Current Inflation Scenario

As of now, India is grappling with elevated levels of retail inflation, which has consequences for the purchasing power of consumers and overall economic stability. The Consumer Price Index (CPI) has shown fluctuations, impacting various sectors. The following table illustrates recent trends in retail inflation:

| Month | CPI Inflation Rate (%) |

|---|---|

| January 2023 | 6.01 |

| February 2023 | 6.44 |

| March 2023 | 5.96 |

| April 2023 | 6.07 |

| May 2023 | 6.43 |

The Risks of Repo Rate Cut

Governor Shaktikanta Das has emphasized that reducing the repo rate at this juncture could be “untimely and very risky.” A premature cut could exacerbate inflationary pressures already felt by consumers. Factors such as rising commodity prices and supply chain disruptions contribute to this persistent inflation and could negate the positive effects of lower borrowing costs.

Economic Growth vs. Inflation Control

The balancing act between stimulating economic growth and controlling inflation is at the forefront of monetary policy discussions. While a lower repo rate can encourage spending and investment, it must be weighed against the potential for higher inflation rates. The Reserve Bank of India (RBI) faces the challenge of fostering a conducive environment for growth without triggering runaway inflation.

Future Outlook

The outlook for monetary policy remains uncertain. Analysts suggest that maintaining a cautious approach is vital until inflation shows consistent signs of declining toward the RBI’s target range. The monitoring of global economic trends, domestic consumption patterns, and inflation indicators will play a critical role in shaping future decisions on the repo rate.

In conclusion, the stance of RBI Governor Shaktikanta Das regarding the repo rate reflects a prudent approach to navigating the complex economic landscape of India. The current high levels of retail inflation necessitate careful consideration before implementing any cuts to the repo rate. As the economy continues to evolve, the importance of strategic monetary policy becomes ever clearer, ensuring that growth does not come at the expense of stability.