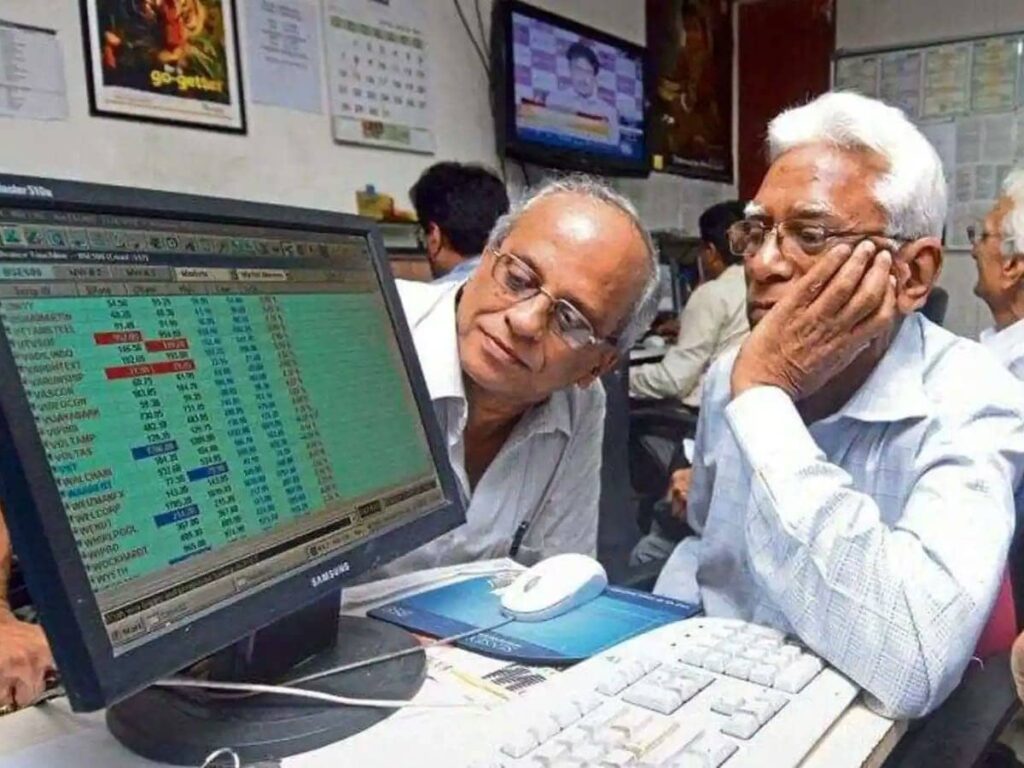

The recent stock market crash in India highlights the growing concerns among investors and the impact of global factors on domestic markets. For the fifth consecutive session, the Indian stock exchanges have faced sharp declines, driven by significant outflows of foreign institutional investors (FIIs), weakening global cues, and apprehensions regarding potential trade wars between major economies, including the United States. This article delves into the reasons behind the crash, the implications for Indian markets, and potential recovery strategies.

Understanding the Factors Behind the Market Crash

Foreign Institutional Investor Withdrawals

Foreign institutional investors have been a significant driving force in Indian markets over recent years. However, their recent withdrawal raises alarm bells. Factors prompting FIIs to pull back include:

- Rising interest rates in developed markets.

- Concerns over geopolitical tensions affecting investment confidence.

- Profit-booking after substantial market gains in previous sessions.

Weak Global Signals

The Indian market’s performance is closely linked to global economic indicators. Recently, signs of a slowdown in key economies and softening commodity prices have contributed to investor apprehensions. Key global signals include:

- Declining manufacturing indices in the United States and Europe.

- Fluctuating crude oil prices impacting inflation rates.

- Inconsistent earnings reports from major global corporations.

Concerns Over Trade Wars

Heightened tensions between the United States and other nations regarding trade policies create uncertainty in markets worldwide. Investors fear potential tariffs and escalated trade disputes, which could adversely affect economic growth and corporate earnings across various sectors. Notable impacts can be summarized in the table below:

| Country | Potential Impact |

|---|---|

| United States | Increased tariffs on imports could lead to inflation and slow down consumer spending. |

| China | Retaliatory measures could disrupt supply chains and affect global production. |

| India | Export uncertainties may hit the textile, agriculture, and manufacturing sectors. |

The Implications of the Crash on Indian Markets

The ongoing stock market crash has far-reaching implications for the Indian economy. Key concerns include:

- Investor Sentiment: Continuous decline may erode investor confidence, leading to further withdrawals.

- Market Volatility: Increased volatility could deter new investments, destabilizing market conditions.

- Potential Economic Slowdown: If the trend continues, it might slow down economic growth, affecting employment and consumption.

Strategies for Recovery

While the current scenario seems bleak, there are potential recovery strategies for investors and the market at large:

- Diversification: Investors should diversify their portfolios to mitigate risks associated with market fluctuations.

- Focus on Fundamentals: Identifying fundamentally strong companies can provide stability during turbulent times.

- Long-Term Investment Perspective: Adopting a long-term view can help investors withstand short-term volatility.

Conclusion

The Indian stock market’s recent crash underscores the interconnected nature of global finance and domestic investment climates. With foreign institutional investors pulling back, combined with weak global signals and trade war concerns, the future remains uncertain. However, by focusing on diversification, long-term strategies, and monitoring fundamental strengths, investors may navigate these turbulent times, positioning themselves for recovery as global conditions stabilize.