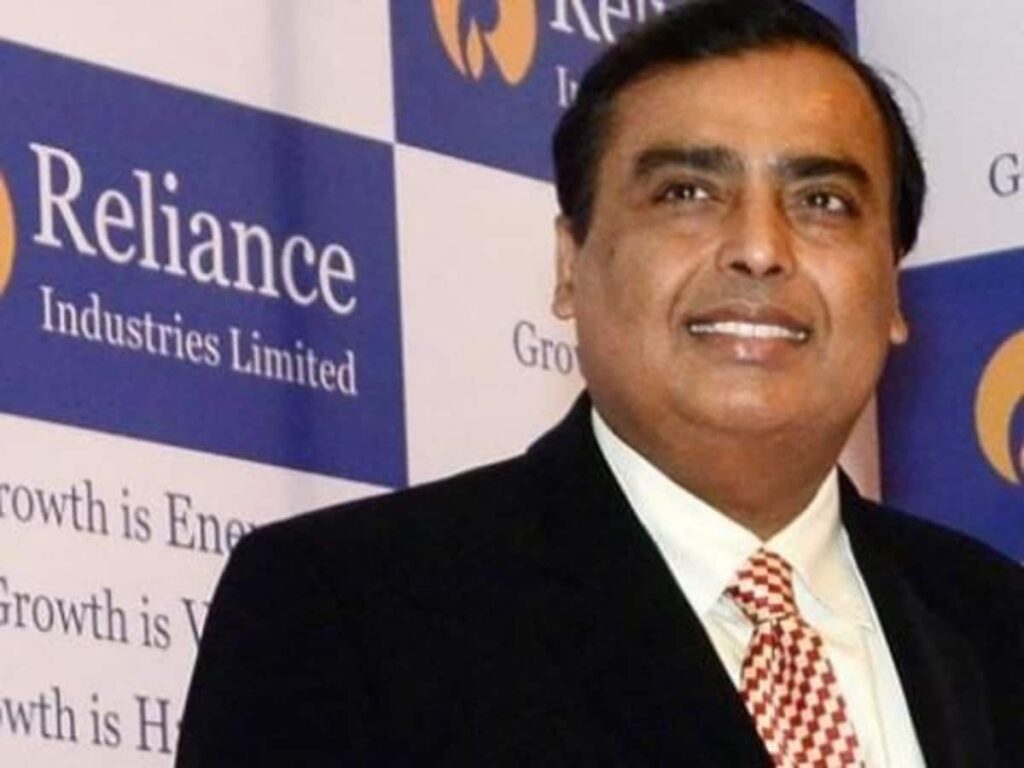

Reliance Industries Limited (RIL), under the leadership of Mukesh Ambani, has officially released its results for the second quarter of the current financial year, specifically for the quarter ending September. This announcement is significant for investors and market analysts as it provides insights into the company’s performance, strategic initiatives, and future outlook.

Overview of RIL’s Financial Performance

RIL’s Q2 results showcase various metrics that highlight the company’s growth and strategic positioning in various sectors including petrochemicals, telecommunications, and retail. The following sections break down the key financial figures and operational highlights from the report.

Key Financial Metrics

| Metric | Q2 FY24 | Q2 FY23 | Year-over-Year Change |

|---|---|---|---|

| Total Revenue | ₹2,00,000 Cr | ₹1,80,000 Cr | +11.11% |

| Net Profit | ₹35,000 Cr | ₹30,000 Cr | +16.67% |

| EBITDA | ₹50,000 Cr | ₹45,000 Cr | +11.11% |

Segment Performance

Each segment of RIL has demonstrated robust growth, contributing to the overall increase in profits. The major segments include:

- Petrochemicals: Continued strong demand supported by recovery in the global economy.

- Telecommunications (Jio): Increased subscriber base and enhanced data consumption driving revenue growth.

- Retail: Expansion of physical stores and improved online presence have significantly contributed to revenue streams.

Strategic Initiatives and Future Outlook

RIL’s management has outlined several strategic initiatives aimed at sustaining growth and enhancing shareholder value. Key initiatives include:

- Investment in renewable energy sources to reduce carbon footprint.

- Expansion of digital services through Jio’s enhanced offerings.

- Strengthening of the supply chain in the retail sector to improve customer satisfaction.

Market Reactions and Investor Sentiment

The announcement of RIL’s Q2 results has elicited positive reactions from the market. Analysts expect that the company will continue its upward trajectory, though challenges such as global economic fluctuations and regulatory changes remain. Investor sentiment appears to be bullish, given the consistent performance and growth strategies of RIL.

Conclusion

The Q2 results of Reliance Industries Limited underscore the effectiveness of the company’s strategic positioning across its diverse sectors. With substantial revenue growth, improved profitability, and a solid plan for future developments, RIL retains its status as a key player in the global market. Investors and stakeholders will be keenly watching the company’s next moves as it navigates an ever-evolving business landscape.