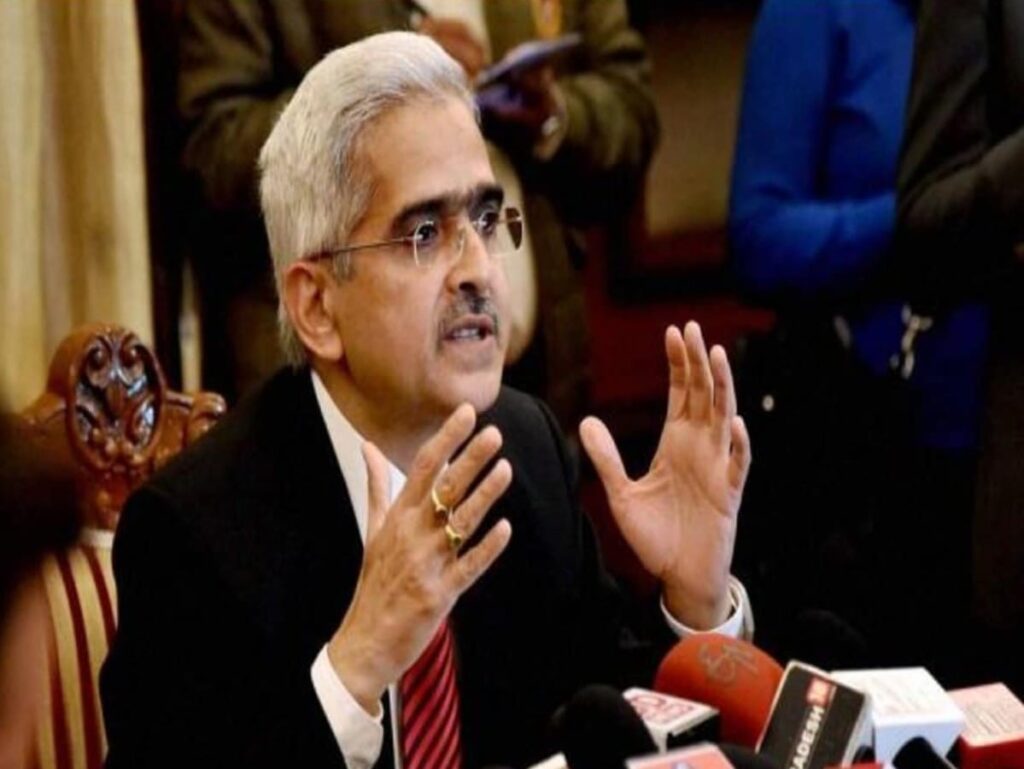

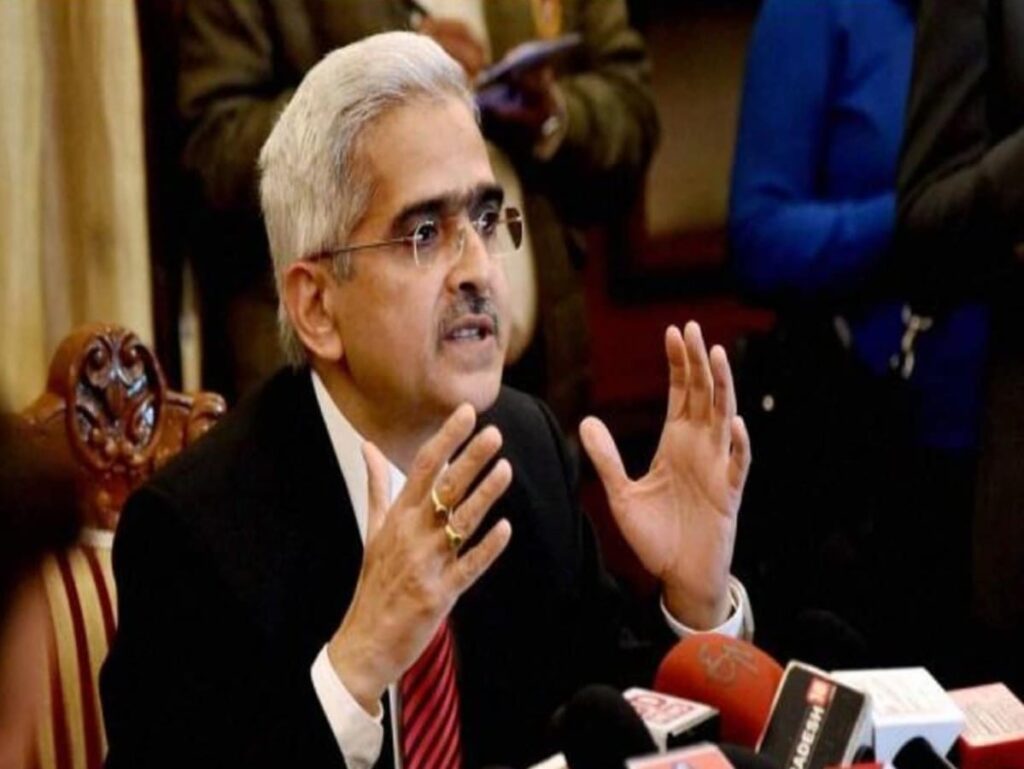

No more risks: RBI Governor’s clear stance on inflation

The Reserve Bank of India’s (RBI) external committee member, Nagesh Kumar, recently voted in favor of a 0.25 percent reduction in the repo rate. This decision carries significant implications for the Indian economy and signals a pivotal moment for the RBI as it embarks on the journey to normalize its monetary policy. In this article, ...